US Foreign Policy

Trade, Immigration, Investment, and Monetary Policy

Michael E. Flynn

Kansas State University

Updated: 2021-11-08

Lecture Overview

Terminology

Historical Background

Why do these topics matter?

Trade, immigration, investment, and monetary policy as foreign policy tools.

Key Questions

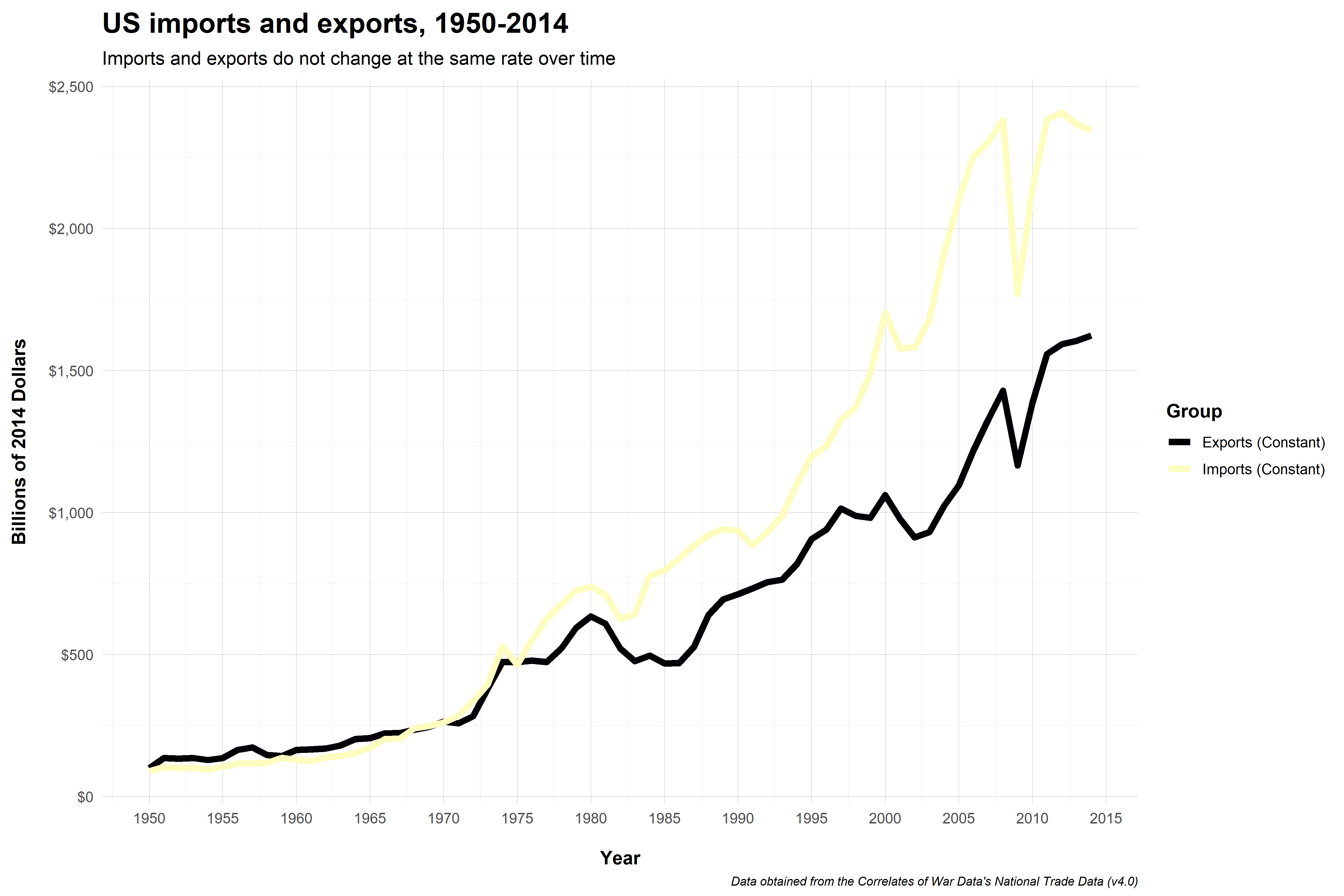

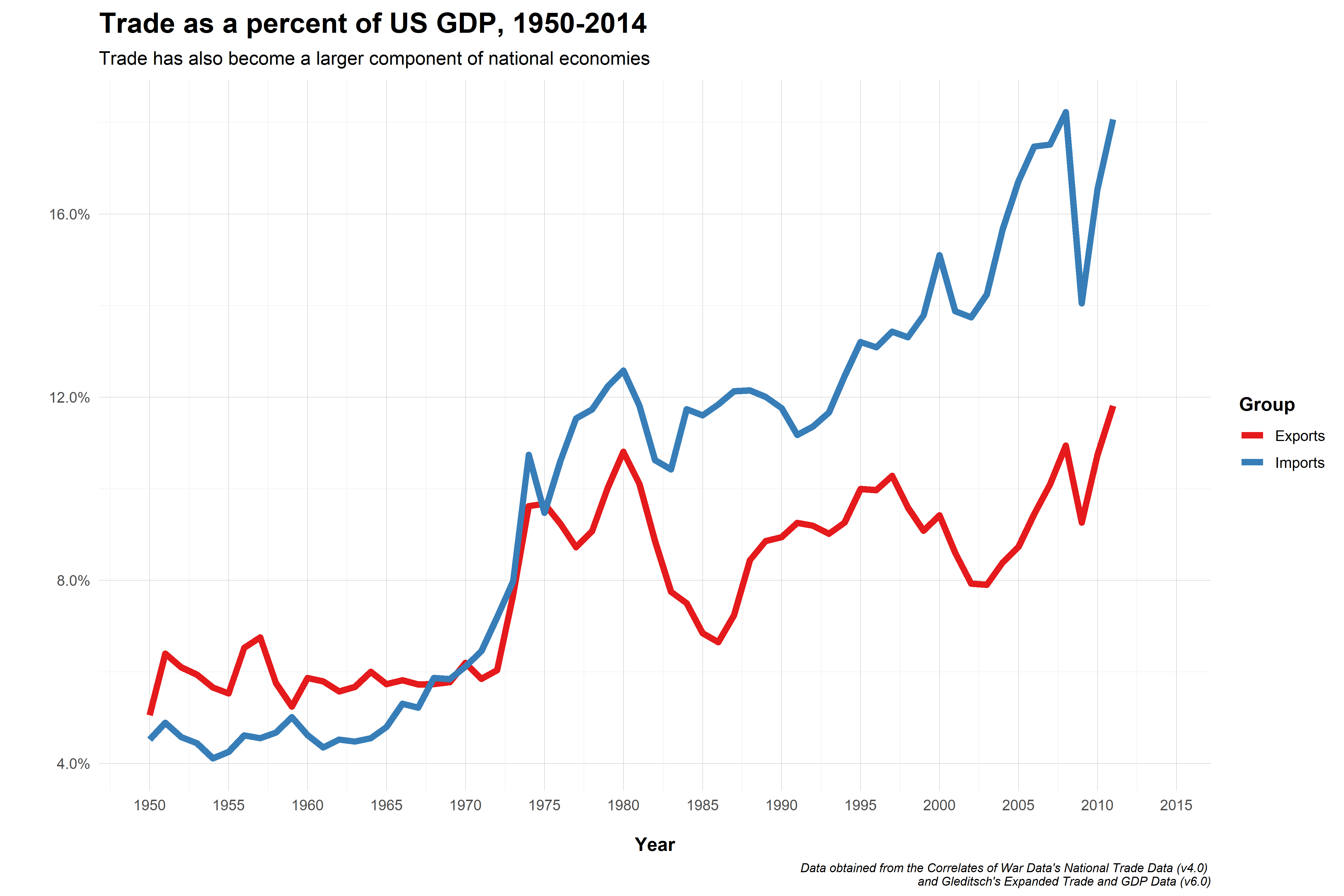

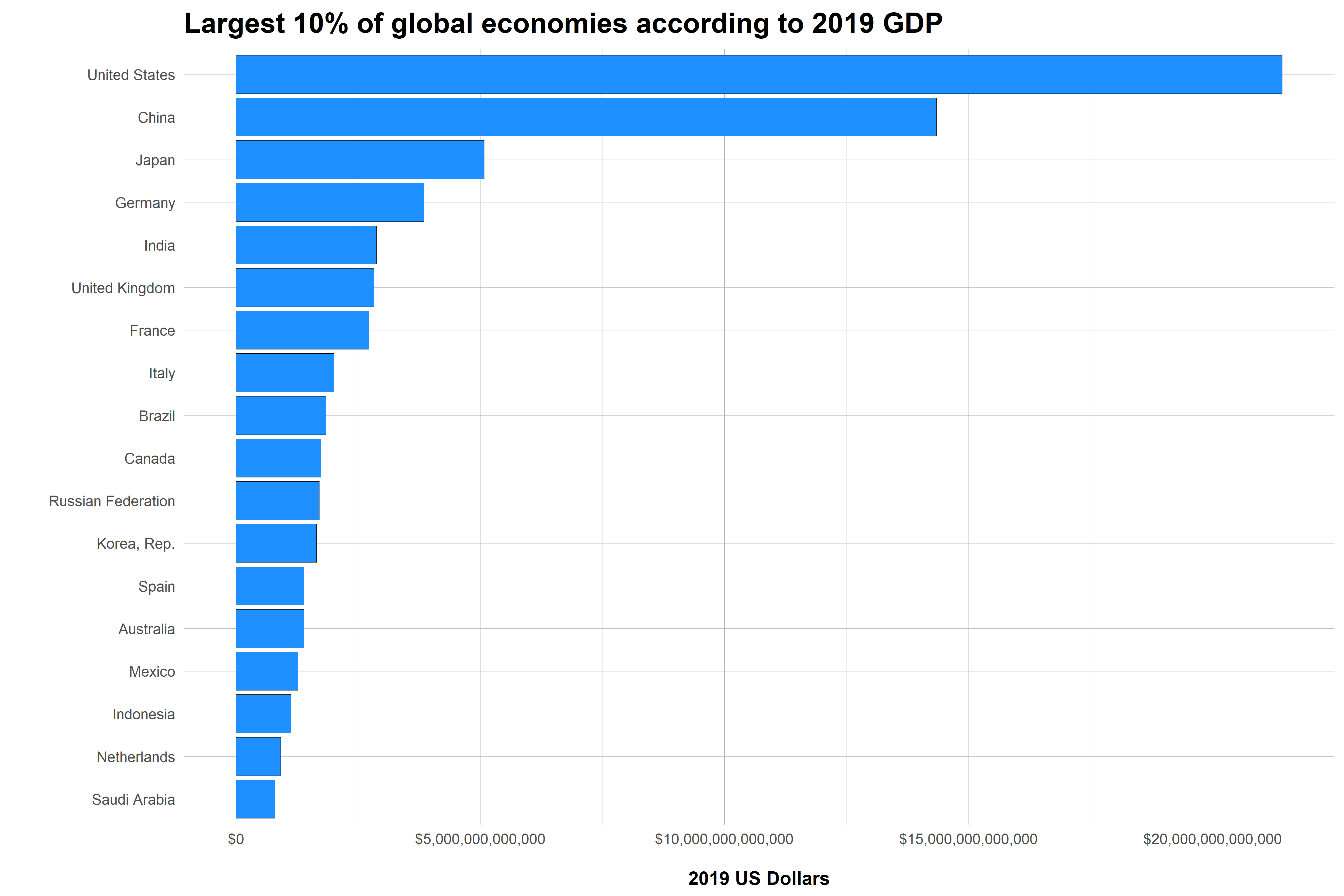

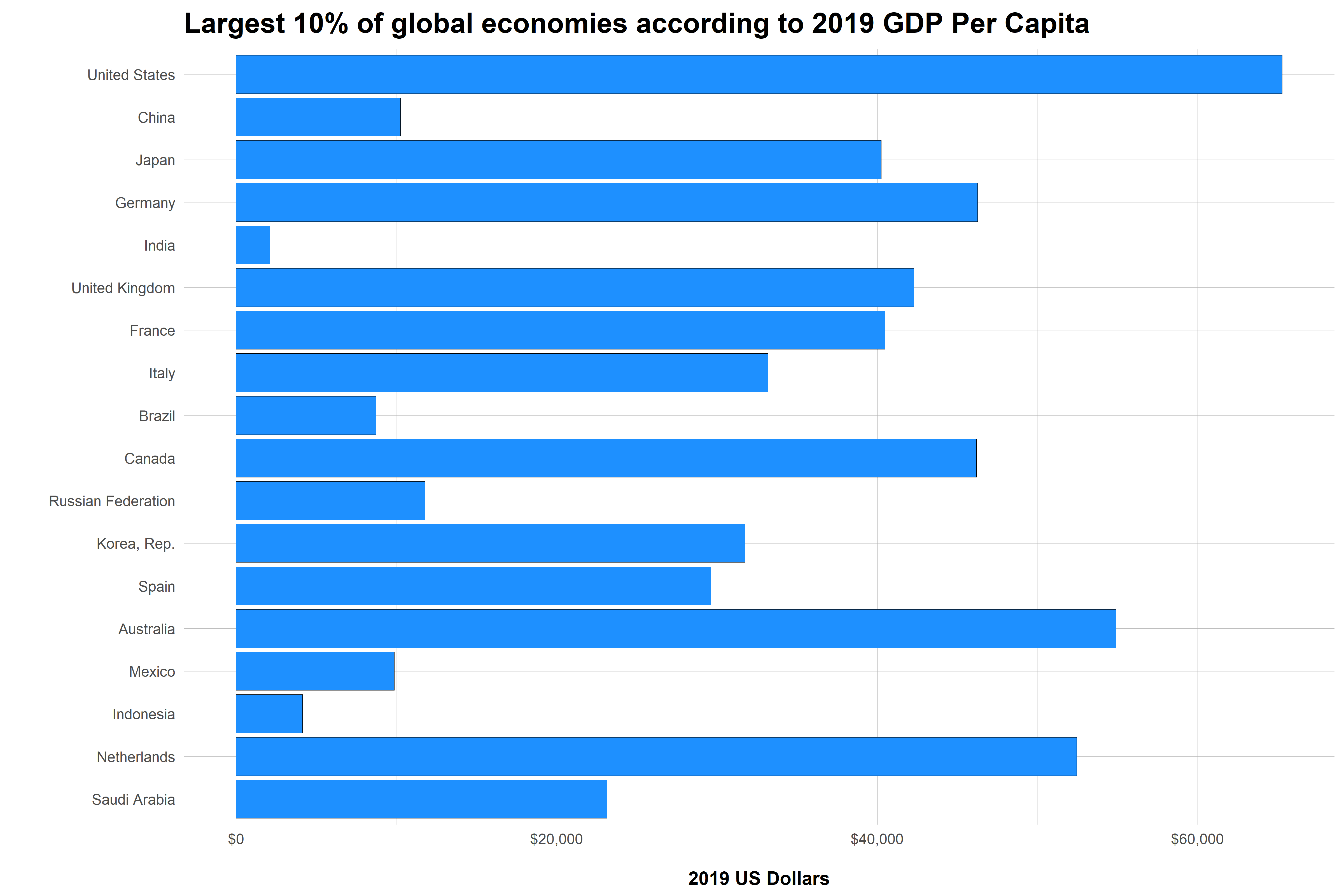

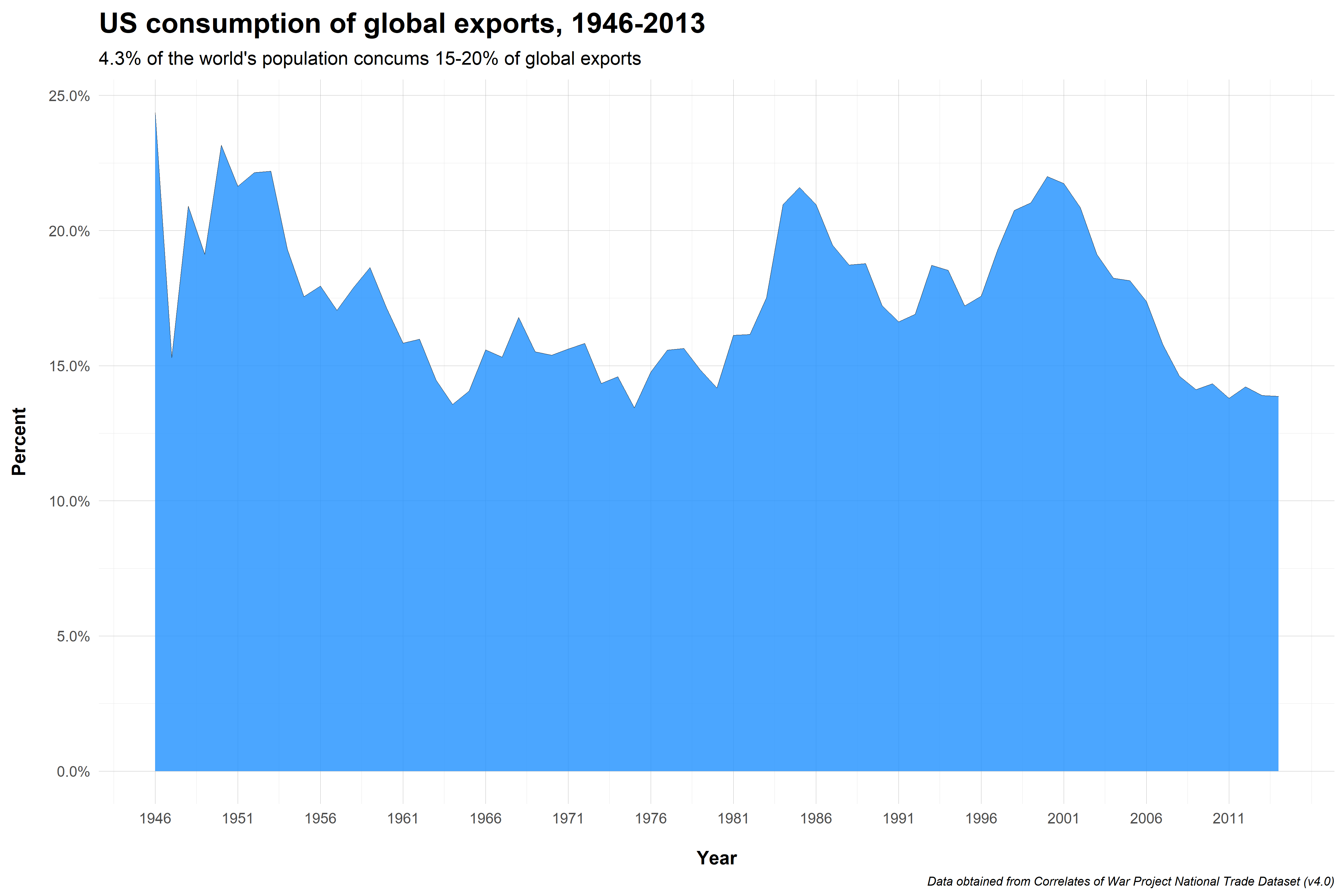

How has the importance of trade to the US economy changed over time?

What is protectionism? What role has it played in the history of US development?

What is the difference between fiscal and monetary policy? How do they relate to one another?

How does an industry's size relate to its ability to get protectionist policies?

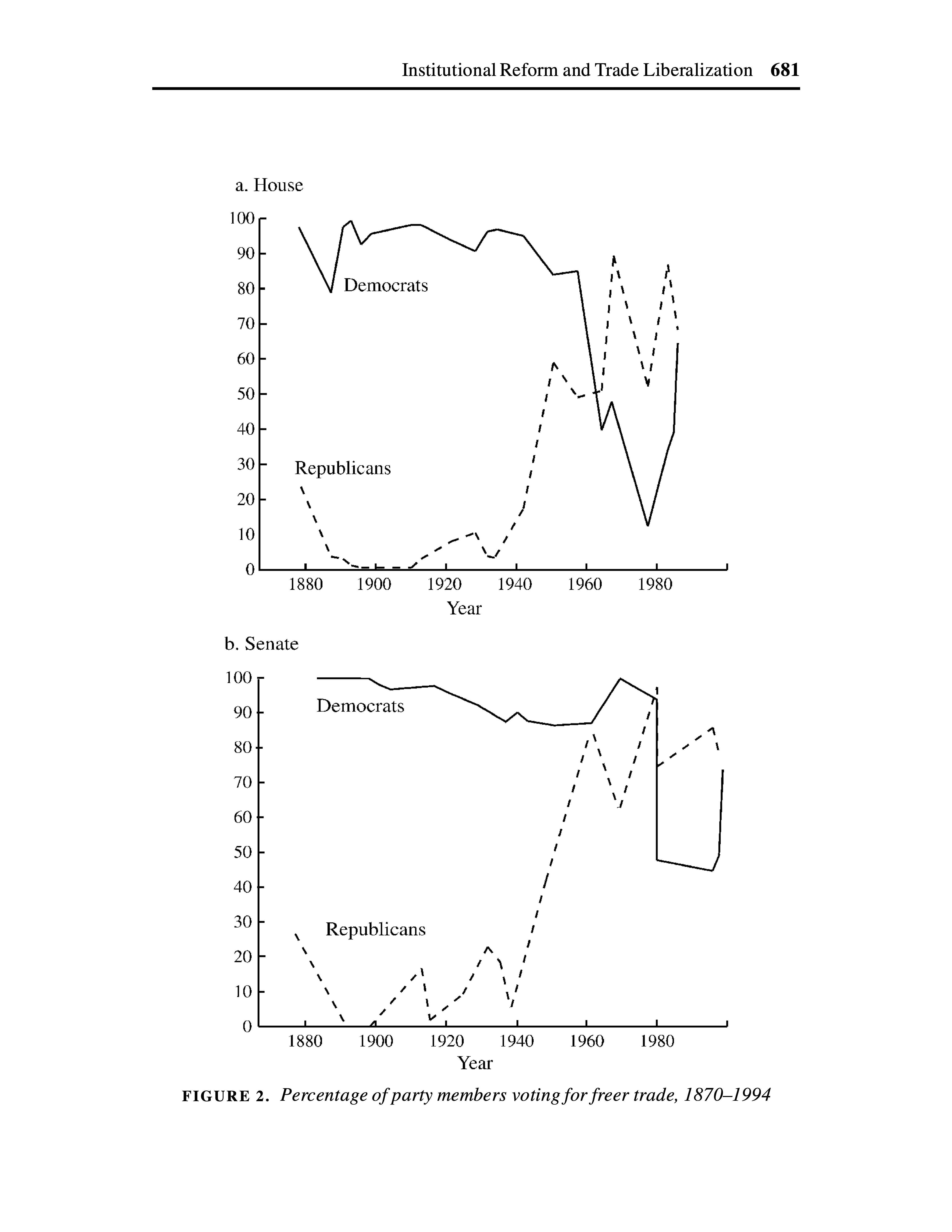

What are the positions of the two major parties been on trade policy? How have they changed over time?

What are some of the major changes in immigration policy across US history?

How has immigration been a tool of US foreign policy?

Terminology

Terminology

Trade

Trade: The flow of goods and services between countries

Imports: Goods and services that are consumed within a referent country but produced in another.

Exports: Goods and services that are produced within a referent country for consumption in another.

Aggregation: We can talk about how to group different businesses or products (specific items, technologies, industries, sectors, etc.)

Notes

Example of aggregation: North American Industry Classification System Item #311111: Dog and cat food (e.g., canned, dry, frozen, semimoist), manufacturing.

Another: 311330 Cocoa, powdered, mixed with other ingredients, made from purchased chocolate

Terminology

Finance and Monetary Policy

Finance: Refers to the flow of capital (cash) within and across borders

- Portfolio Investment

- Sovereign Lending

- Foreign Direct Investment (FDI)

Monetary Policy: Refers to the supply and valuation of currenty

- Interest rates

- Money supply

Historical Background

Historical Background

Historical Background

Trade before 1934

Protectionism is dominant approach to US economic development

Northeastern manufacturing interests had substantial political influence and favor protectionist policies

Southern and Western agricultural interests less influential and favor freer trade polices.

Historical Background

Trade after 1934

Northeastern and Southern interests align in 1930s and 1940s

Both groups come to support freer trade

Protectionist barriers begin to come down

World War II marks an important turning point

Historical Background

Bretton Woods System

Partly a reaction to pre-World War II move to autarky

Three main components

- General Agreement on Tariffs and Trade (GATT)

- International Monetary Fund (IMF)

- International Bank for Reconstruction and Development (World Bank)

Notes

- GATT focuses on promoting free trade and lowering tariff barriers

- IMF focuses on short-term imbalances in payments between states

- World Bank promotes development in less developed countries

Why Does Trade Matter?

Why Does Trade Matter?

Theoretical

Realism/Mercantilism

Trade as a source of national power

Trade is a zero-sum game

Liberal theory

Trade can be positive-sum (both/multiple players can "win")

Trade has other beneficial effects (e.g. it promotes peaceful relations between states)

Notes

- Historically nations very wary of trade as it might enrich adversaries

- Adam Smith and David Ricardo came along and talked about the benefits of specialization and free markets.

- We see greater moves towards free trade throughout the 1800s, mostly as a response to British leadership and technological change

- Ideas gain steam in 20th century through Woodrow Wilson's 14 Points

Why Does Trade Matter?

Tangible benefits

Trade creates jobs

Access to desirable goods (spices, cool cars, technology, media/entertainment)

Less tangible

Soft power and prestige

Information, education, etc.

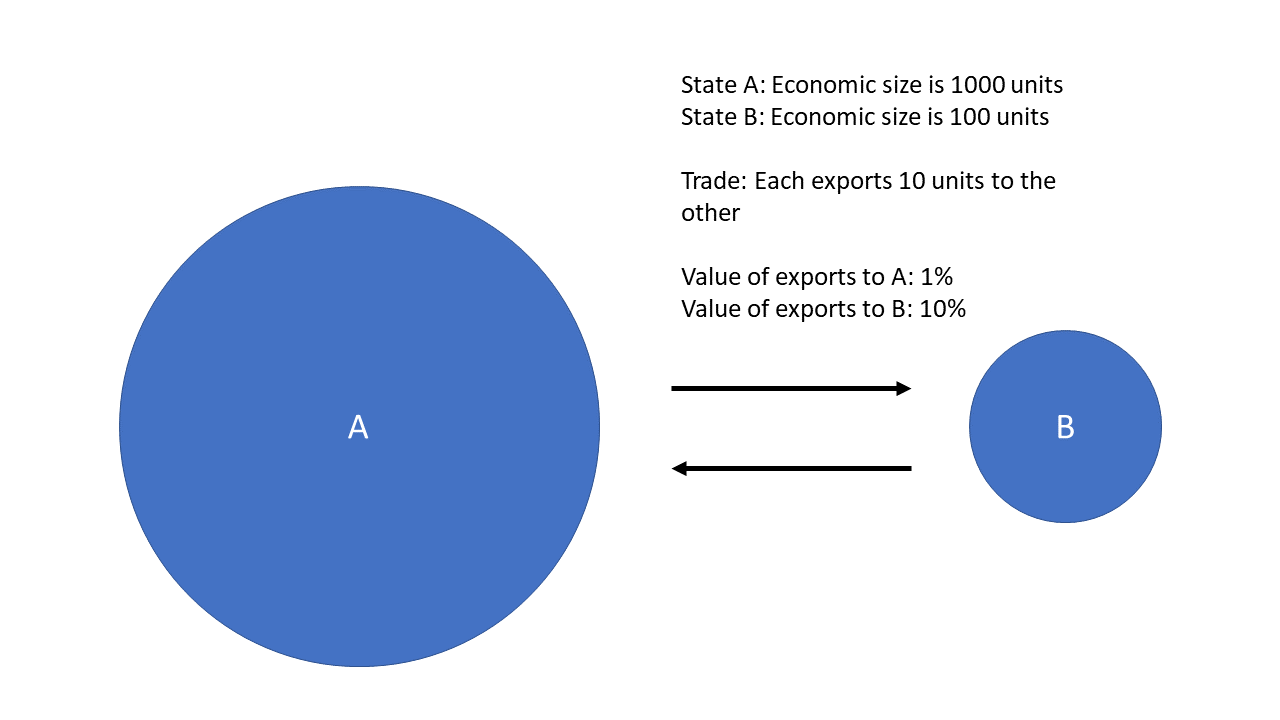

Trade as a Policy Instrument

Trade as a Policy Instrument

Trade can be a source of power

Control over vital resources

Necessary for survival of the state, everyday life, etc.

Few substitutes, few alternative suppliers

Trade as a Policy Instrument

Market access

Producers need markets. Scaling up production requires larger markets.

Exports bring in money from the sale of goods

Domestic consumer base is often limited in various ways (money, taste, interests, etc.)

Provides bargaining power

Trade as a Policy Instrument

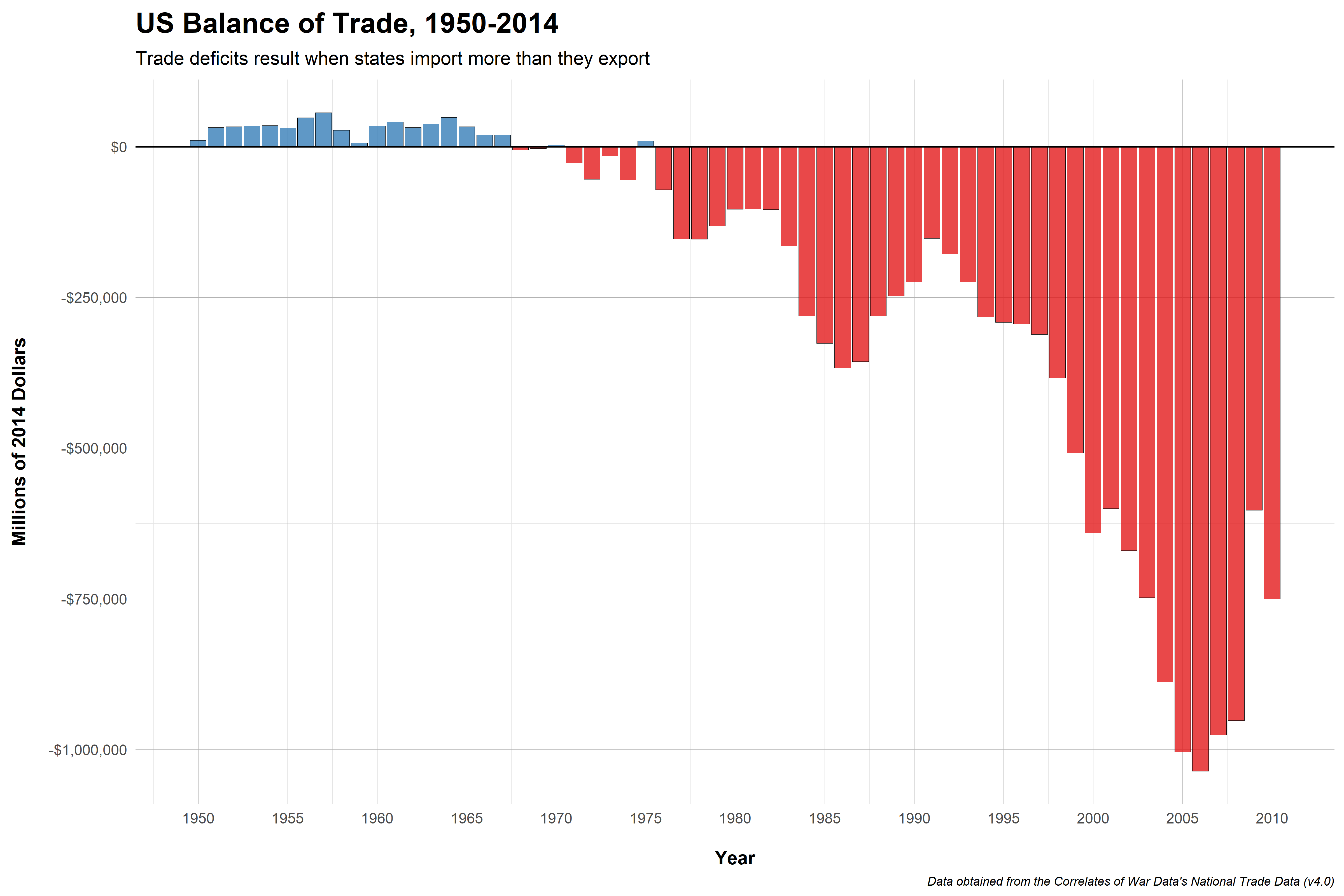

Does this mean trade is hurting your economy?

Trade as a Policy Instrument

Does this mean trade is hurting your economy?

No!

Trade as a Policy Instrument

Does this mean trade is hurting your economy?

No!

Let's look at how GDP is calculated:

GDPit=Consumptionit+Investmentit+Governmentit+(Exportsit−Importsit)

Trade as a Policy Instrument

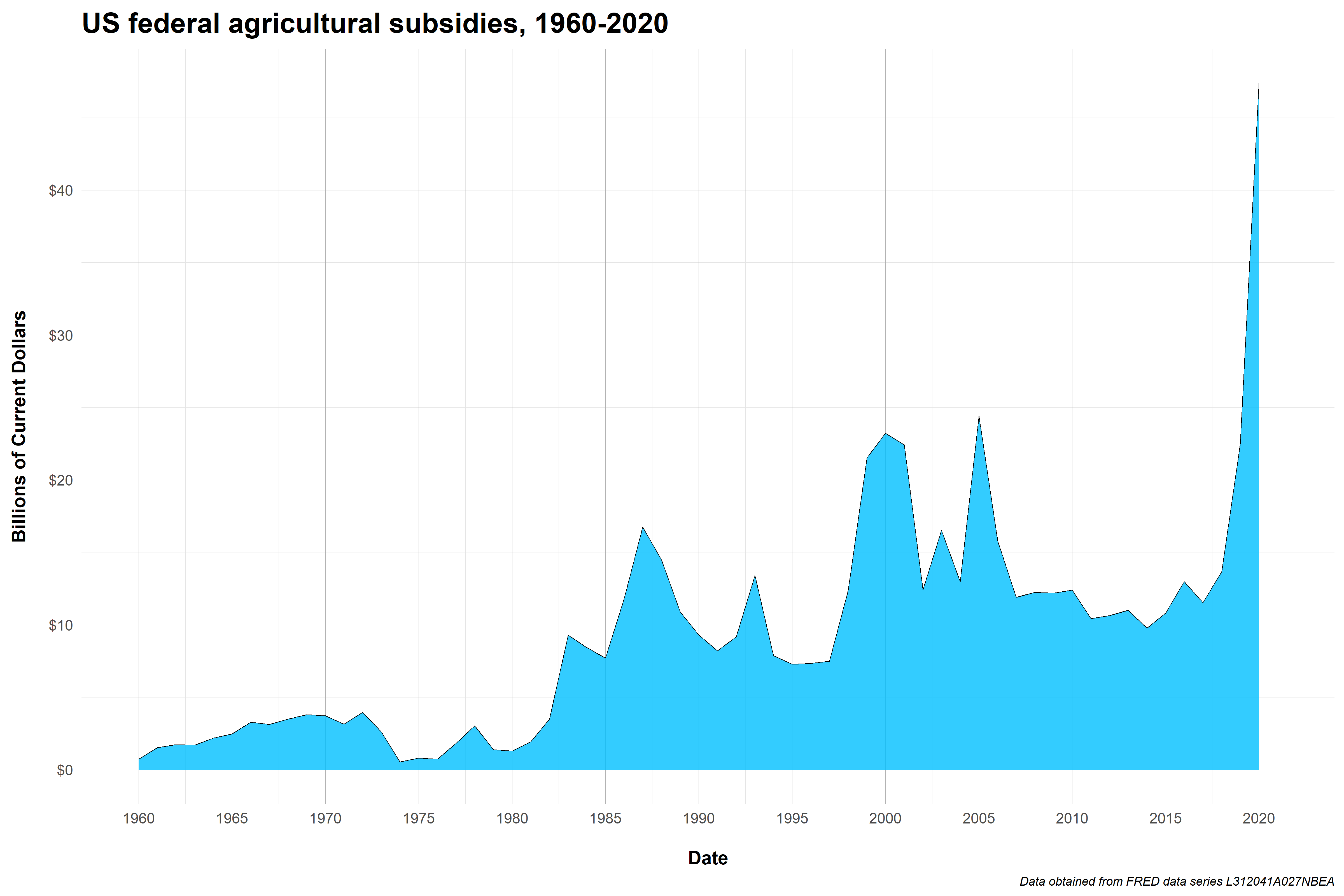

Protectionism

Trade creates winners and losers

Some countries can produce goods more/less efficiently than others

Domestic producers who are relatively inefficient tend to favor protectionism (i.e. government intervention)

Trade as a Policy Instrument

Forms of Protectionism

Trade protection can come in a variety of policy interventions

Tariffs: Taxes on imported goods

Quotas: Limits on how much of a good is imported

Subsidies: Government payments to purchase goods or offset costs of donig business

Health and safety regulations: Creating different standards between importers and exporters

Trade as a Policy Instrument

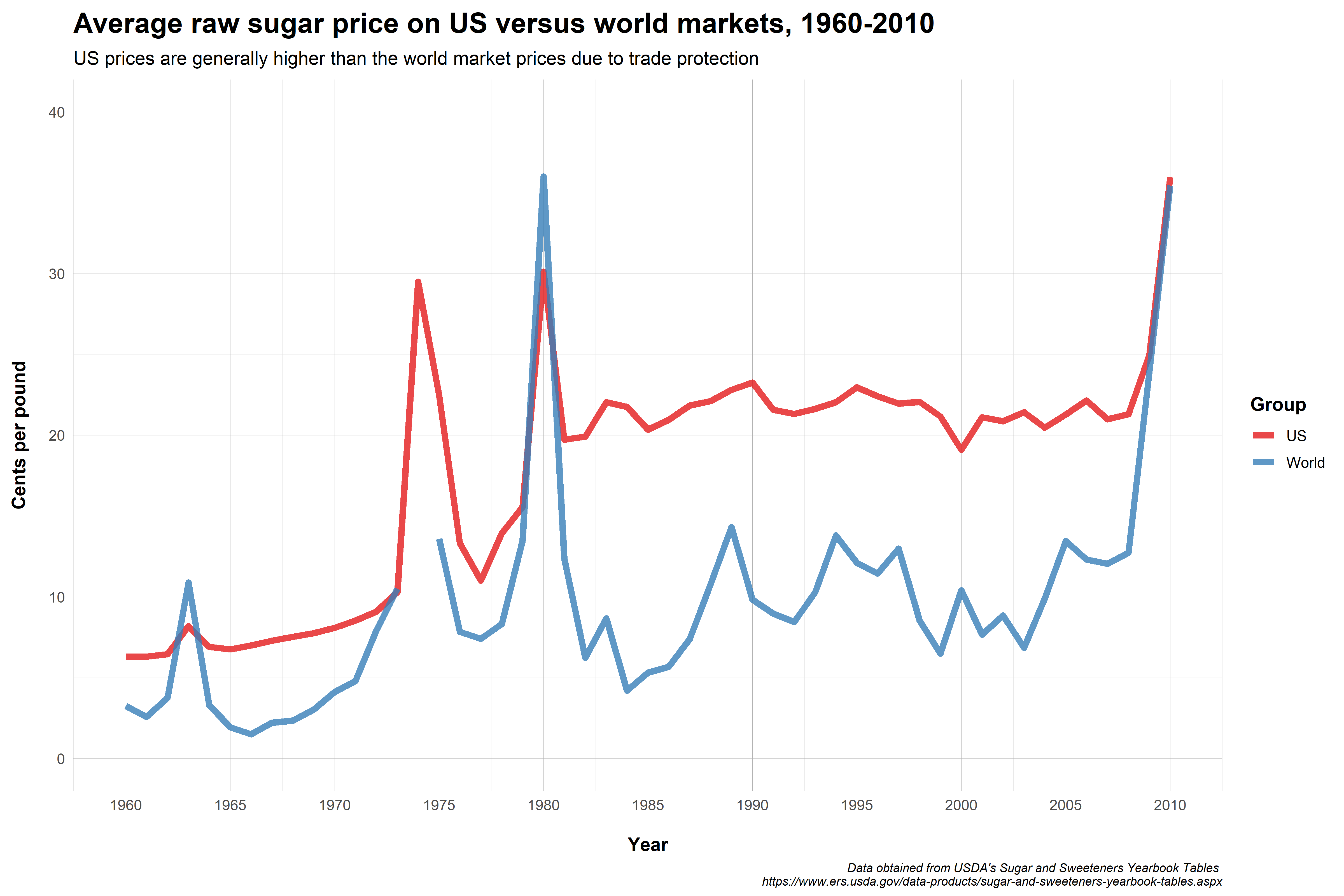

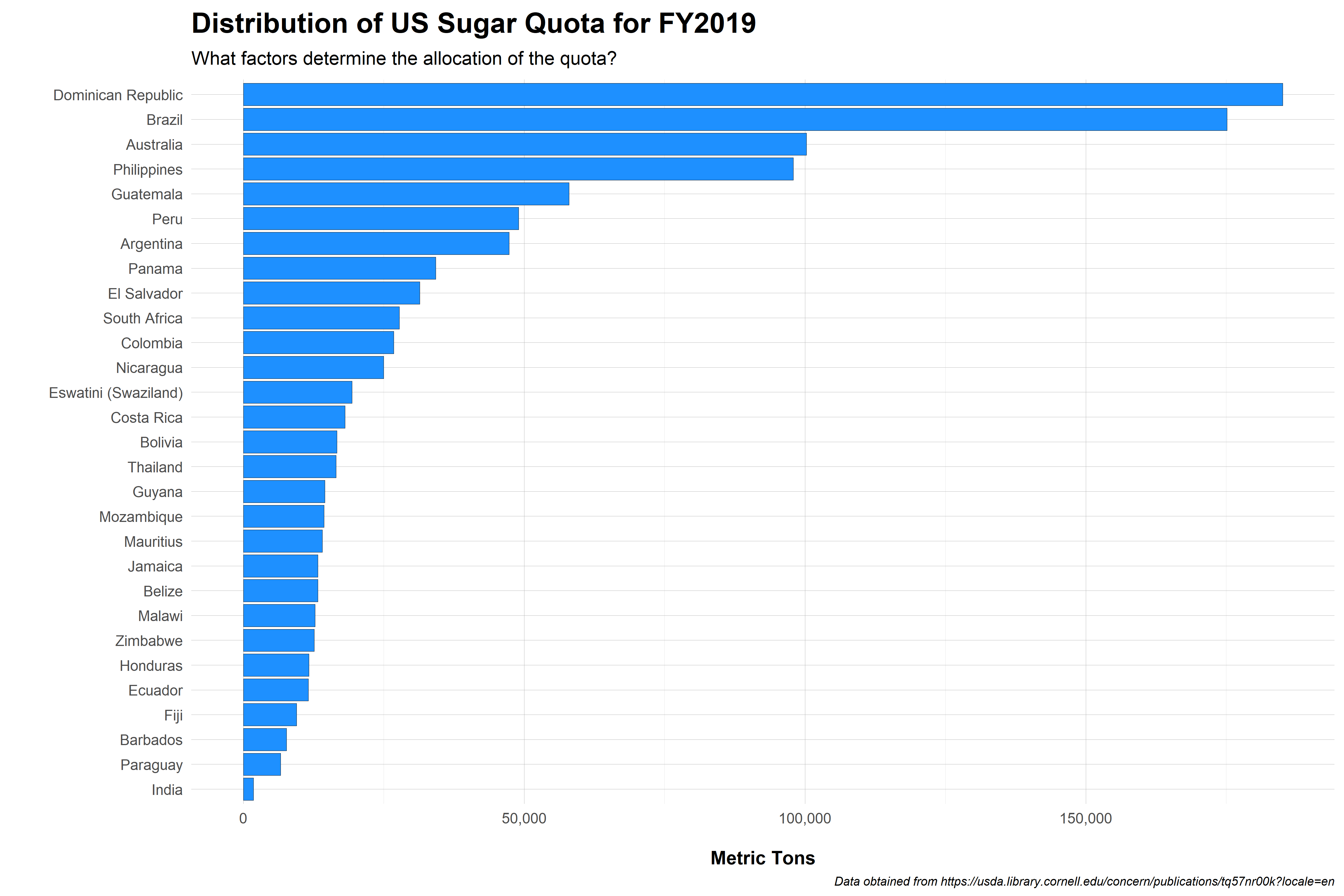

Example: Sugar Quota System

WTO agreements requires the US to import a minimum of 1,117,195 metric tons of raw sugar from global producers

This is an aggregate figure-it does not have to be distributed evenly across sugar producing states

Trade as a Policy Instrument

What is the benefit to foreign countries?

Trade as a Policy Instrument

What is the benefit to foreign countries?

- Dominican Republic share = 185,050 metric tons

Trade as a Policy Instrument

What is the benefit to foreign countries?

Dominican Republic share = 185,050 metric tons

World raw sugar price (2019) ≈ 12.36 cents/lb.

Trade as a Policy Instrument

What is the benefit to foreign countries?

Dominican Republic share = 185,050 metric tons

World raw sugar price (2019) ≈ 12.36 cents/lb.

US raw sugar price (2019) ≈ 26.16 cents/lb.

Trade as a Policy Instrument

What is the benefit to foreign countries?

Dominican Republic share = 185,050 metric tons

World raw sugar price (2019) ≈ 12.36 cents/lb.

US raw sugar price (2019) ≈ 26.16 cents/lb.

Difference = 13.8 cents/lb.

Trade as a Policy Instrument

What is the benefit to foreign countries?

Dominican Republic share = 185,050 metric tons

World raw sugar price (2019) ≈ 12.36 cents/lb.

US raw sugar price (2019) ≈ 26.16 cents/lb.

Difference = 13.8 cents/lb.

So what?

Trade as a Policy Instrument

What is the benefit to foreign countries?

Dominican Republic share = 185,050 metric tons

World raw sugar price (2019) ≈ 12.36 cents/lb.

US raw sugar price (2019) ≈ 26.16 cents/lb.

Difference = 13.8 cents/lb.

So what?

That's about $56.3 million more than world market!

Trade as a Policy Instrument

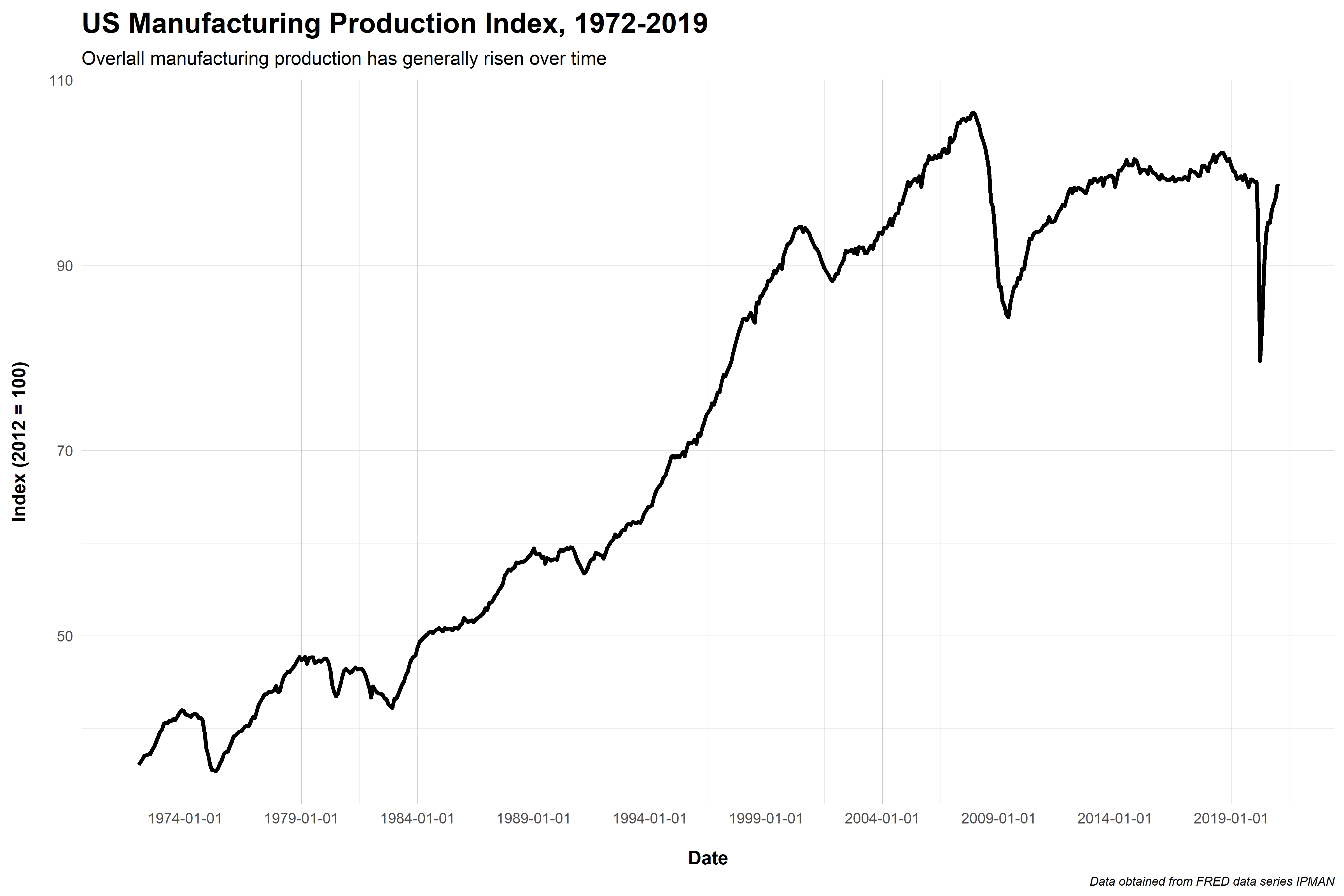

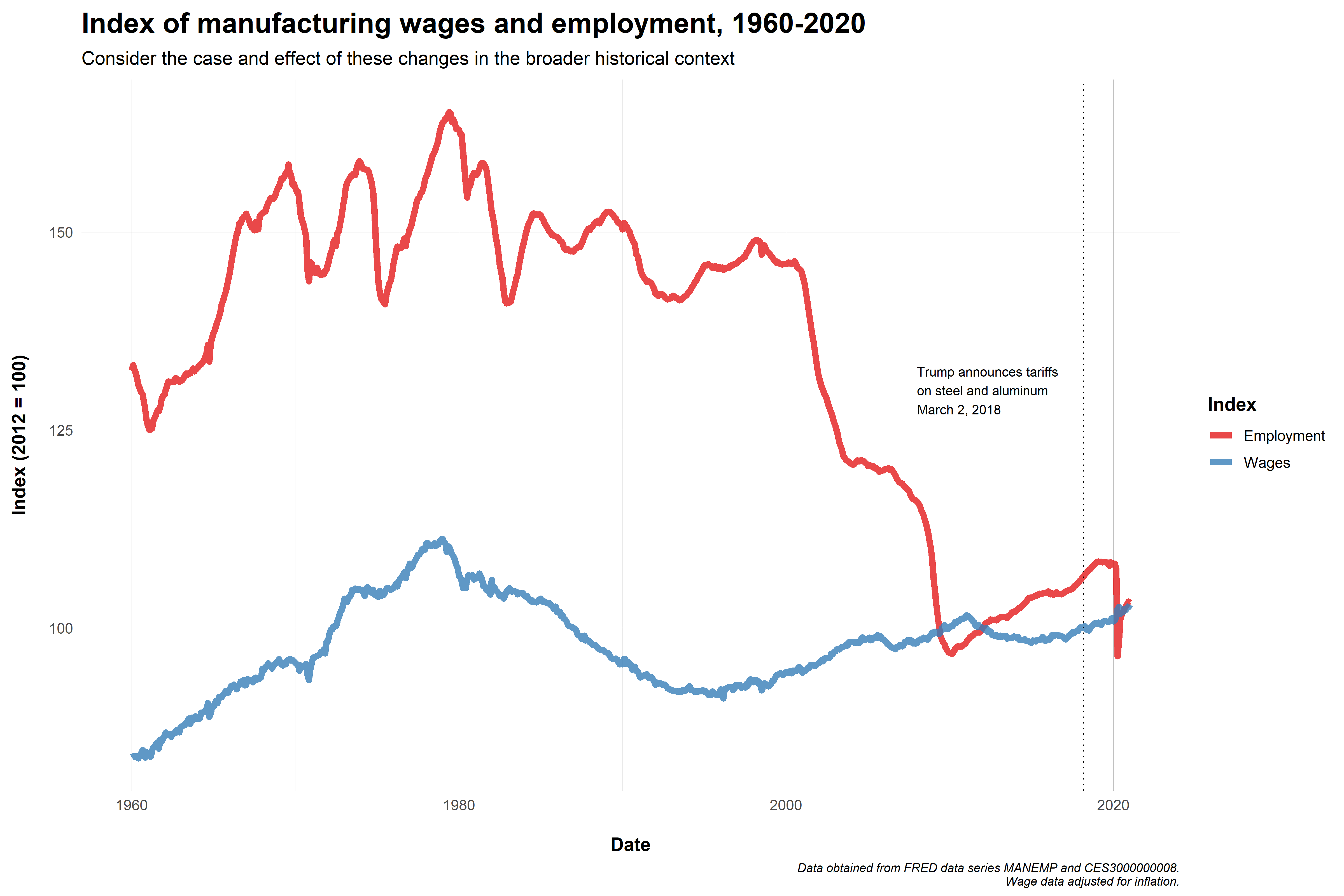

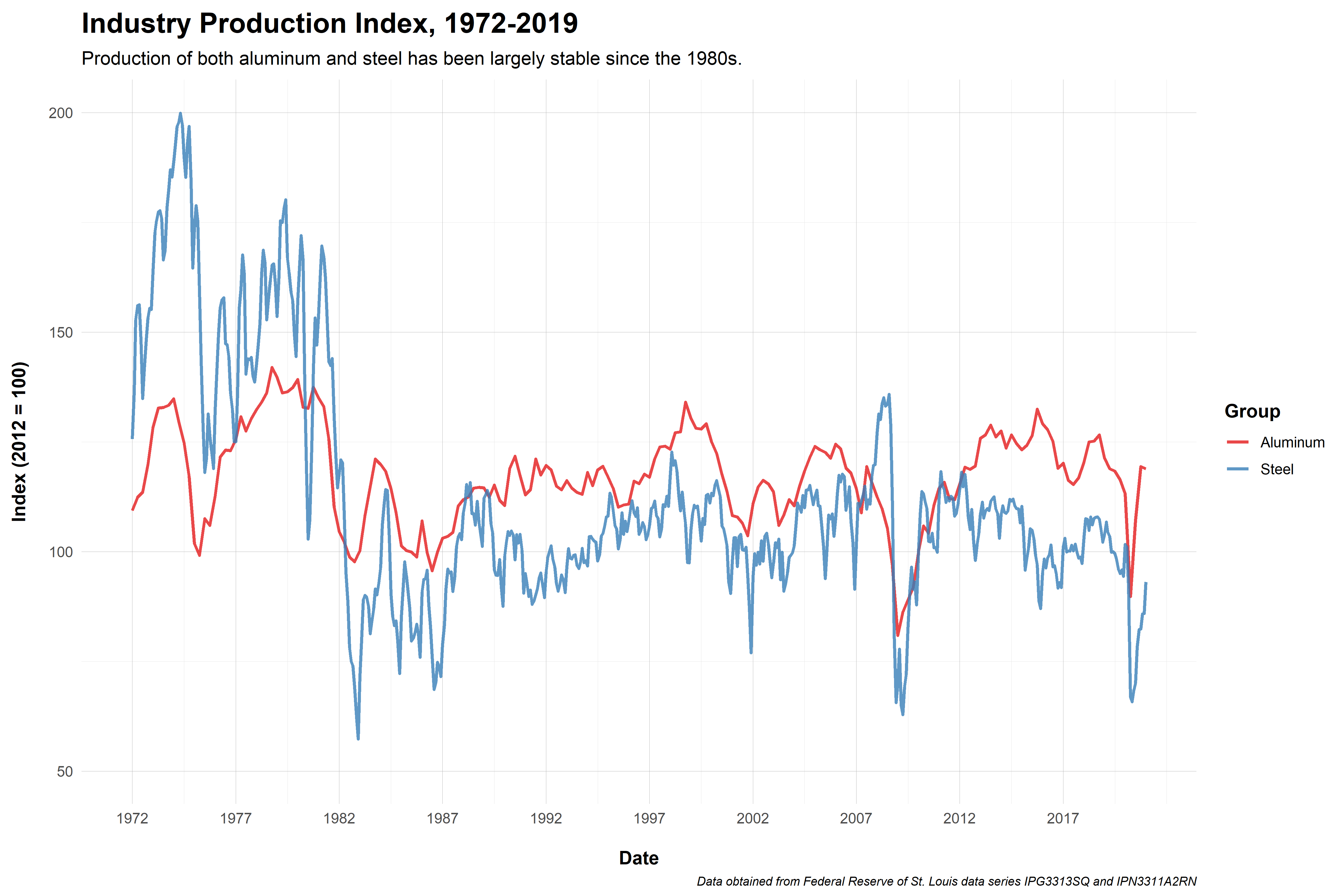

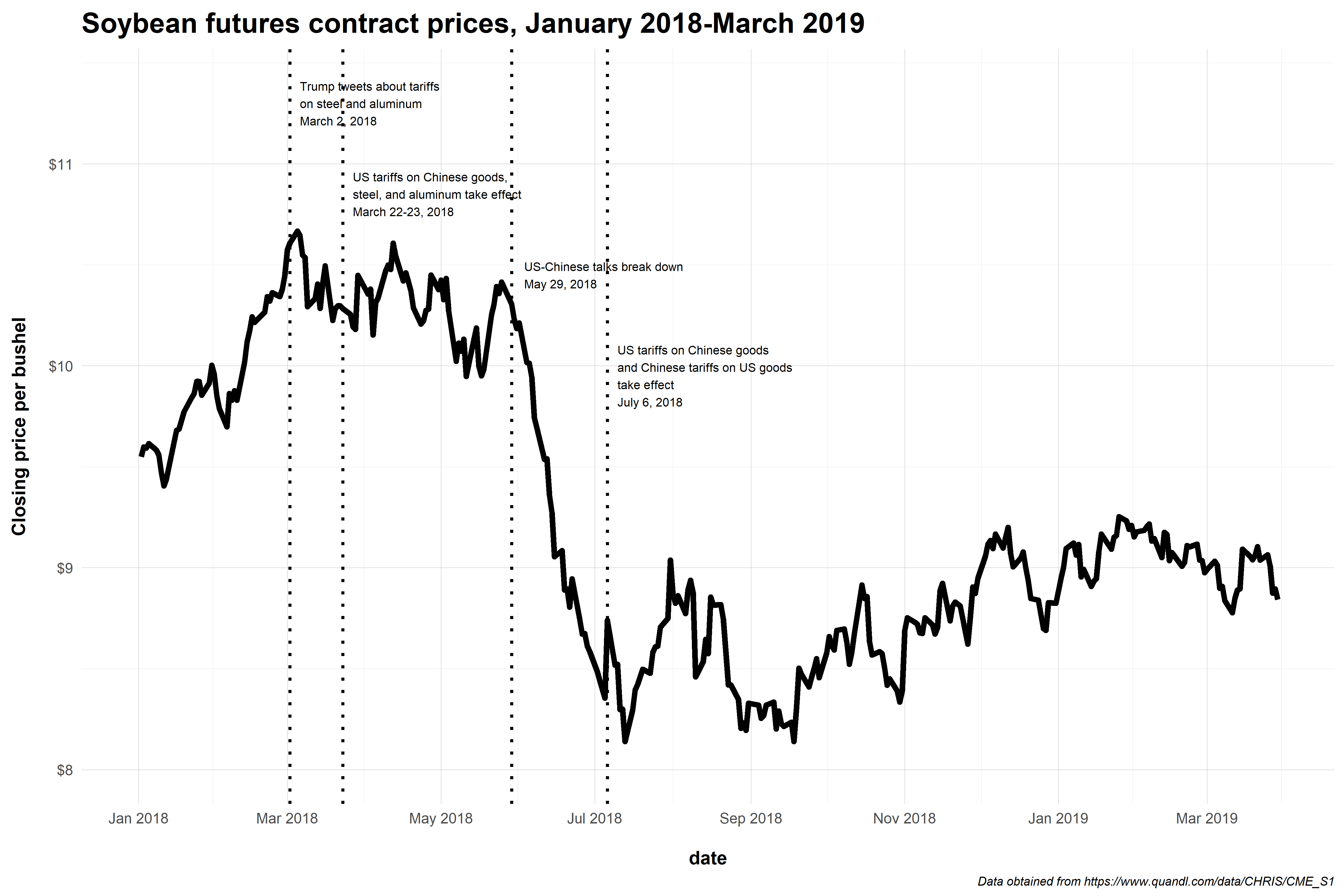

More recent example: Manufacturing

Some industries are politically powerful for reasons apart from economic salience

Manufacturing sector has a lot of influence

Heavily tied into American image of production and the importance of making things

Early Trump economic policies focused on "reviving" US manufacturing, but was it even in need of resuscitation?

Notes

There's really no evidence that Trump's tariffs altered the employment or wage levels/growth that we see here.

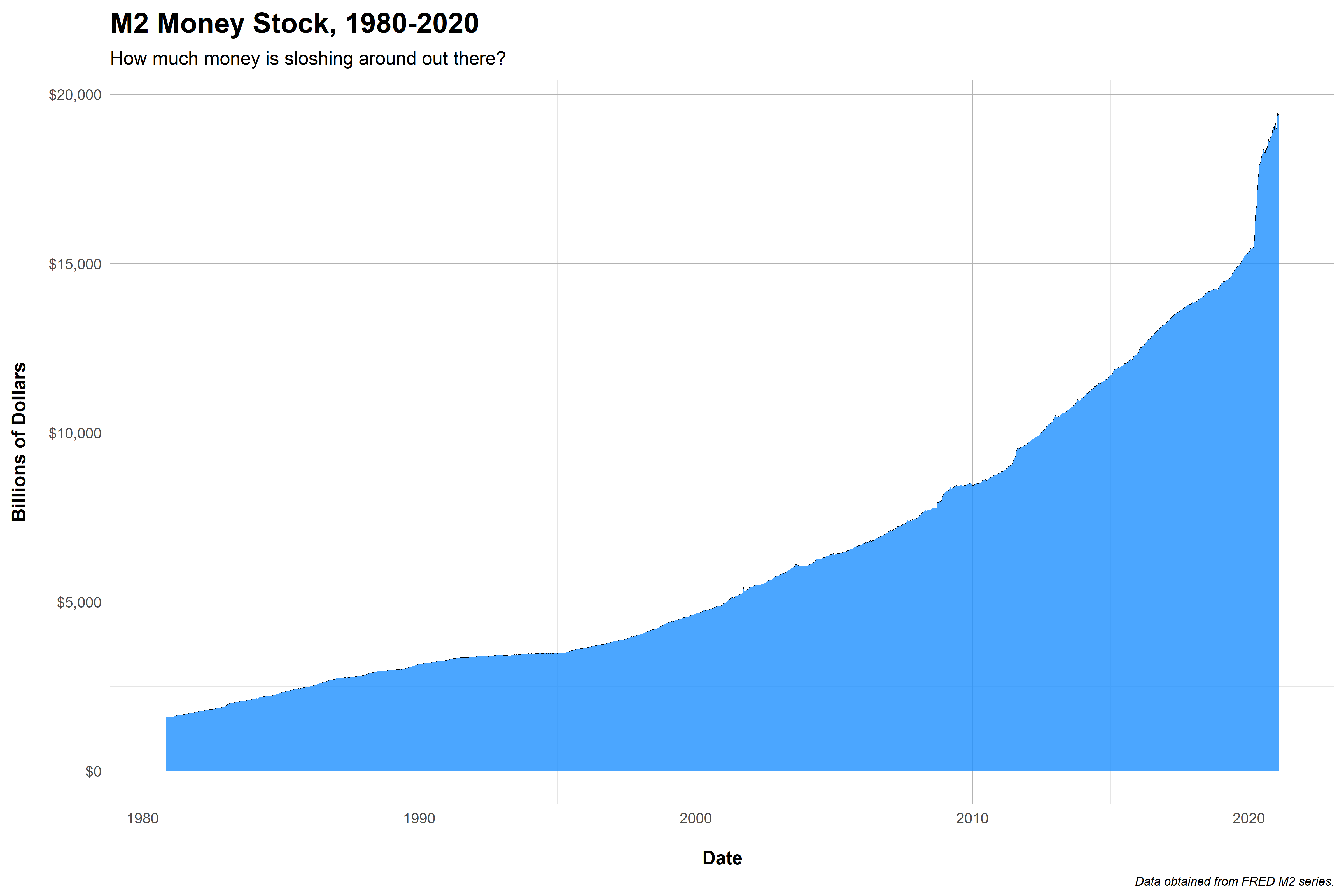

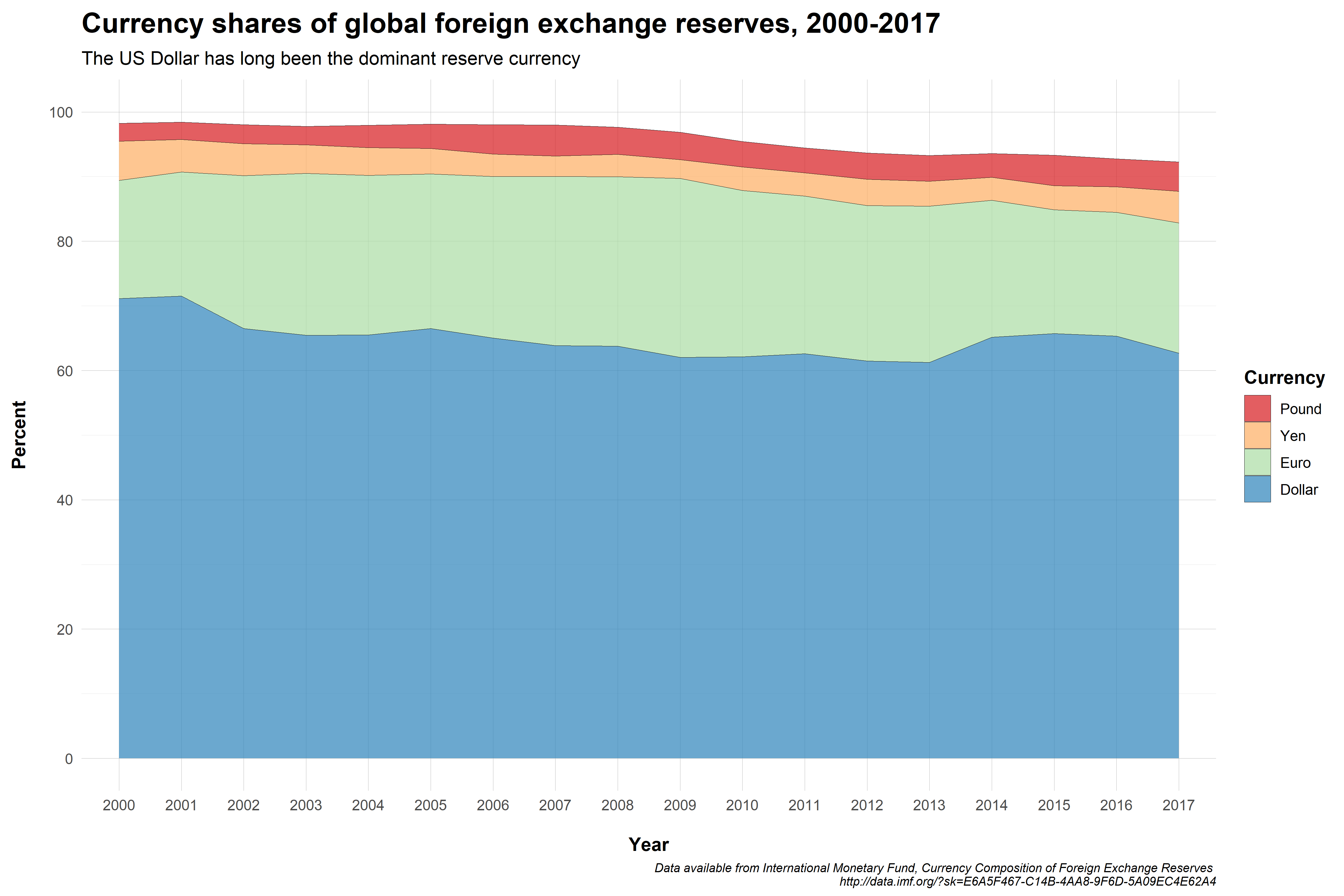

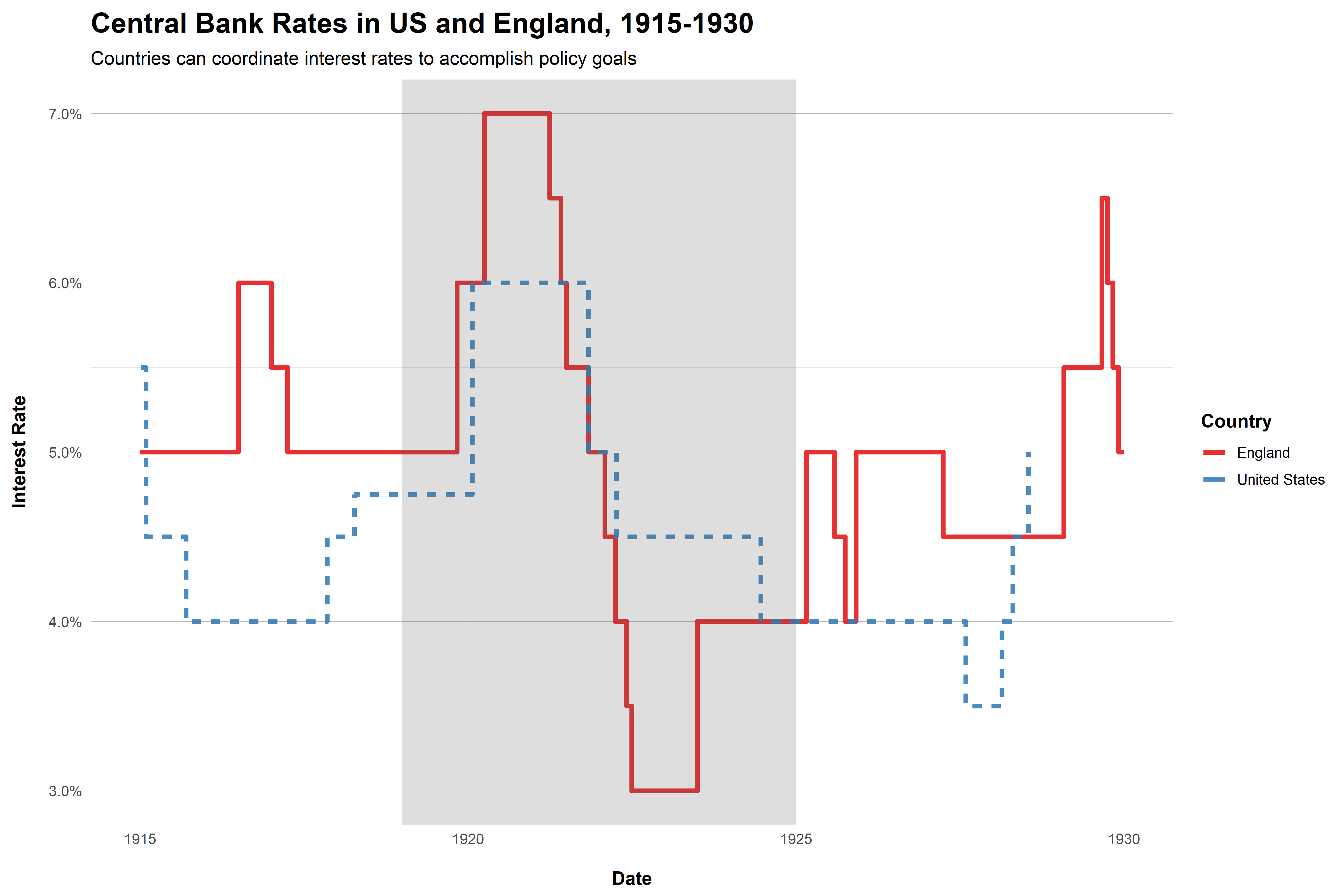

Monetary Policy

Monetary Policy

People need money to buy things

Theoretically, we could use all sorts of stuff!

A commonly held/used/accepted currency (e.g. "brand") of money helps resolve coordination problems

US dollar is widely used and valued, making it a great basis for global commercial exchange

Monetary Policy

So what are we talking about here?

For present purposes, let's focus on two key issue areas

Money supply

Exchange rates

Monetary Policy

Mr. (money) manager

Governments manipulate money and its value through a couple of key mechanisms

Setting interest rates

Buying and selling assets

Monetary Policy

Mr. (money) manager

Governments manipulate money and its value through a couple of key mechanisms

Setting interest rates

Buying and selling assets

People use the dollar, so what?

Well, when you print your own currency and that currency is used as a global reserve currency, you've got options!

Immigration Policy

Immigration Policy

A Brief Overview of US Immigration Policy

- Immigration was largely unregulated until the late 1800s

- US government starts keeping track more systematically in 1819 with the Steerage Act

- Immigration Act of 1864 creates positions within the State Department to oversee immigration, but Act is repealed after 4 years.

- Chinese Exclusion Act of 1882

- Immigration Act of 1882

- Immigration Act of 1891

Immigration Policy

Early Quote System

Immigration policy takes a turn in the 20th Century

- Quota Law of 1921

- National Origins Act of 1924

Immigration Policy

Cold War Period

- Labor shortages during WWII lead to growth in immigration from Mexico

- US eliminates formal race-based quotas on immigration, but de facto policy still prioritizes Western Europe

- Country-specific quotas are gradually eliminated, but broad regional quotas remain

- US policy eventually starts to emphasize humanitarian concerns, partly to stick it to the Soviets

What Drives Immigration?

What Drives Immigration?

Lots of things, but for now we'll focus on a basic IPE approach to political economy

Push Factors

- Lack of economic opportunity (i.e. jobs)

- War and conflict

- Repression and violence

- Crime

Pull Factors

- Basically the same, but the inverse

- Attracted to job opportunities

- Less crime/violence

- More political participation

What Drives Immigration?

Heckscher--Ohlin Framework

- Think of migration in terms of trade theory

- Countries export goods that make intensive use of the factors that are abundant

- Countries import goods that make intensive use of the factors that are scarce

Migration as factor mobility

- Just as investors move capital around seeking a greater return on investment, so too do individuals move trying to find greater returns on their investment (i.e. time, effort, skills, etc.)